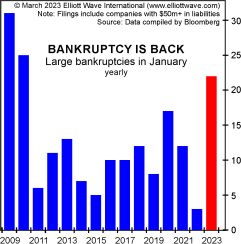

This Bank Warns of a “Default Wave”

Two Deutsche Bank strategists just wrote a study in which they said “a default wave is imminent.”

This May 31 news item from Marketwatch provides details:

By the fourth quarter of 2024, they [the two Deutsche Bank strategists] say the U.S. high-yield default rate will peak at 9%, and the U.S. loan default rate will reach 11.3%. The European speculative-default rate will rise too, though to a less steep 5.8%.

Why? “The tightest Fed and [European Central Bank] policy in 15 years is running into elevated corporate leverage built upon stretched profit margins. This is especially true in the leveraged loan market, where LBO leverage was juiced higher year after year (after year) by zero rates and central bank QE,” they say. LBO means leveraged buyouts, performed by the $5 trillion or so private-equity industry. [emphasis added]

Whether their prediction plays out specifically as described remains to be seen, of course.

The May Elliott Wave Financial Forecast also tackled the subject of defaults. Here’s a chart and commentary:

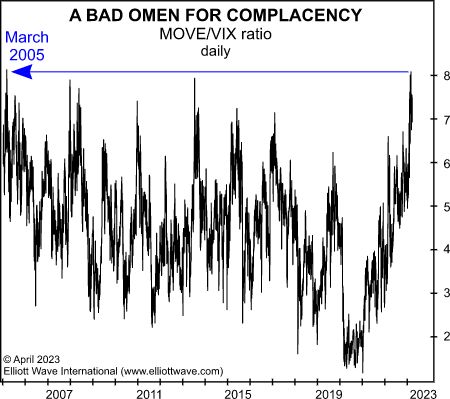

As the Elliott Wave Financial Forecast has said many times, the bond market tends to sniff out impending financial trouble ahead of stocks, and it continues to suggest that the latest default cycle is far from over. This chart illustrates bond market leadership in the form of the MOVE/VIX ratio which surged to 8.07 on April 5, its highest level in 18 years. The prior peak came in the first quarter of 2005. Then as now, it followed an interest rate surge in which yields on the 3-month U.S. Treasury bill jumped from 0.80% in June 2003 to 2.86% in March 2005, a 255% increase. [emphasis added]